Wall Street Executives Brace for European Backlash Amid Escalating Trade War

- by Manner Wood, Washington, RNG247

- about 9 months ago

- 211 views

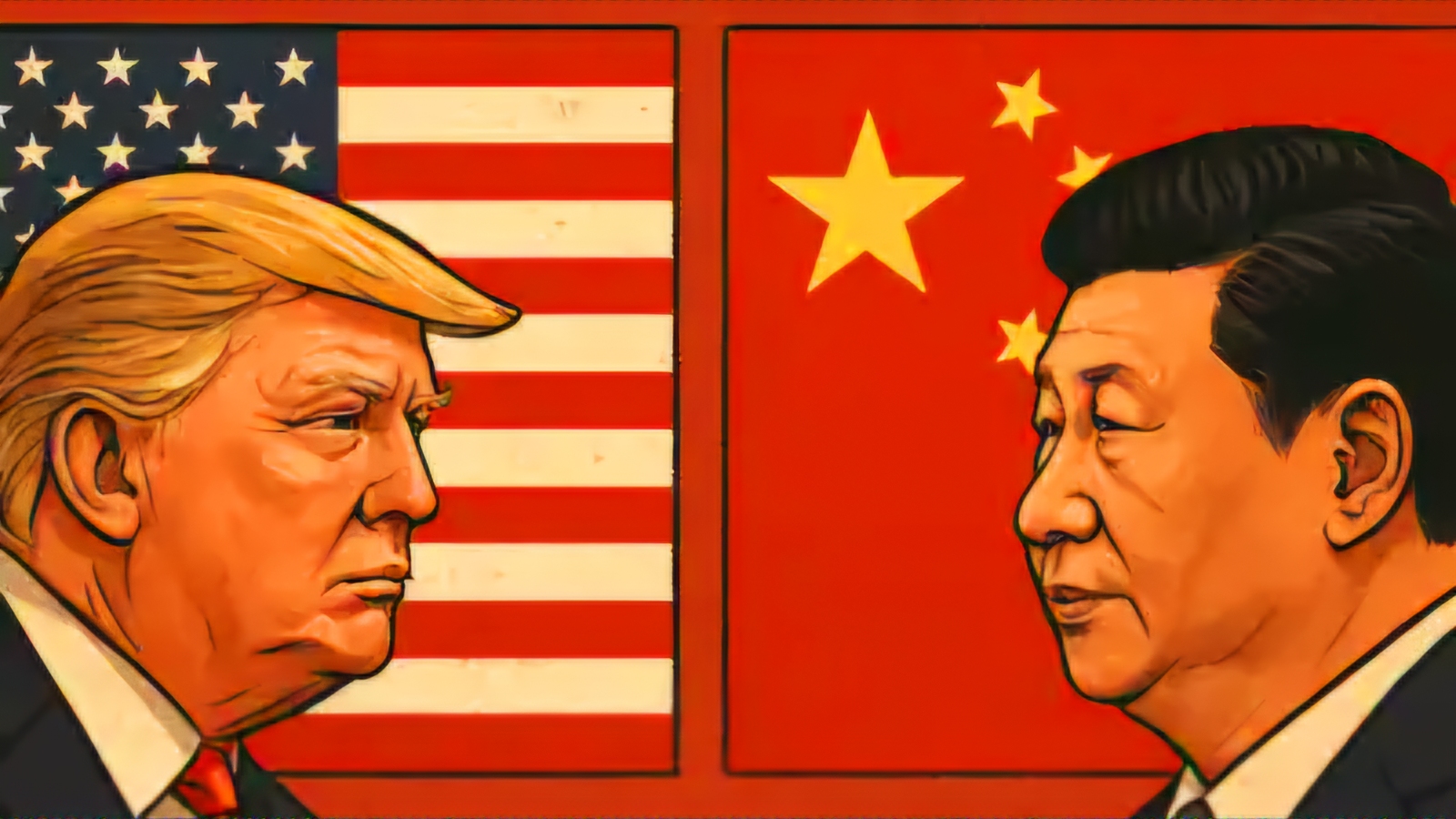

As President Donald Trump escalates his tariff war with traditional allies, Wall Street leaders are increasingly apprehensive about the potential ramifications for American investment banks in Europe. With fears of client boycotts on the rise and the prospect of formal restrictions looming, senior bankers say they are preparing for a potential sidelining by European governments and companies in favor of local financial institutions.

More than half a dozen industry insiders have disclosed to RNG247 that discussions among bank industry groups are underway regarding possible measures that European countries could implement to limit the operations of U.S. banks on their turf. At least two major banks have also engaged in internal deliberations about the fallout from the ongoing trade dispute, according to senior executives who spoke on the condition of anonymity due to the sensitivity of the discussions.

One of the tools at the European Union’s disposal is the **Anti-Coercion Instrument** (ACI), introduced in 2021 as a response to growing concerns over the use of trade as a weapon by both the U.S. and China. The ACI allows the EU to impose restrictions on foreign financial service providers, potentially curtailing their access to lucrative European markets.

In a striking sign of shifting sentiments, French President Emmanuel Macron recently urged European businesses to halt any planned investments in the United States in light of Trump’s extensive tariff measures.

JPMorgan Chase CEO Jamie Dimon, in an interview with Fox Business' "Mornings with Maria," acknowledged the growing anti-American sentiment among clients. “We’ve lost a couple of bond deals already...they simply say they’d rather do business with a local bank than with a U.S. bank,” Dimon disclosed.

Following recent approvals of the EU’s first countermeasures against the United States, which join similar retaliatory actions from China and Canada, concerns intensify about a potential global recession. In response to these developments, Trump announced a temporary reduction of tariffs on numerous countries, though he simultaneously increased them on Chinese imports.

EU Trade Commissioner Maros Sefcovic indicated that the bloc remains ready to explore all possible retaliatory options, stating, “We are prepared to use every tool to protect the single market.”

In the backdrop, officials at the European Central Bank are mobilizing to ensure the stability and financial resilience of the eurozone economy.

Disentangling U.S. banks from Europe’s financial system presents significant challenges. While they constitute a small fraction of regional loans and deposits, American investment firms are dominant in various sectors, especially in securities trading, including derivatives.

U.S. banks have significantly reinforced their foothold in European markets since the 2008 financial crisis—and even more intensely after Brexit. In the wake of the UK's departure from the EU, Brussels mandated that Wall Street banks strengthen their local operations, resulting in the creation of thousands of jobs across Europe.

Though U.S. lenders do not typically disclose their earnings by region, data indicates the scale of their operations, with Germany, the UK, and France representing JPMorgan's first, second, and fourth-largest country exposures outside the U.S. respectively. According to LSEG data, U.S. firms accounted for the majority of investment banking fees in Europe in the first quarter of 2025, earning approximately $514 million, or 8.2% of the total fee pool.

However, history has shown that Europe is adept at navigating complexities—most notably demonstrated during Brexit, when a major partner was effectively disentangled from the EU structure. Experts suggest any restrictions on U.S. firms may be partial rather than total.

The Eroding Edge of U.S. Banks

“The advantage of U.S. banks is eroding,” remarked a senior financial executive who requested anonymity. Clients are increasingly weighing their options for securities trading, pondering whether to transition to European counterparties—discussions that would have seemed implausible just a year ago.

High-profile deal-making for companies like Volkswagen and Porsche has highlighted the substantial influence of U.S. banks over their European counterparts. Yet, several EU-based advisors report a noticeable uptick in the hiring of local banks for various transactions.

Concerns are circulating among U.S. firms that financial leverage could be weaponized in the trade conflict, a sentiment echoed by their European allies, who worry about potential limitations on credit access and dollar provisions from American banks.

As European companies reconsider their reliance on U.S. financing, discussions around the possibility of losing access to U.S. dollar funding lines are gaining traction among banks and corporations in the region—a move that could significantly destabilize the European financial landscape.

Some European officials have started to question whether they can continue to depend on the U.S. Federal Reserve for dollar funding during market turmoil. One insider articulated, “For Europeans, the question is whether they would prefer to nurture national champions. The global landscape is shifting toward nationalism, presenting political risks associated with U.S. banks.”

Yet, not all agree with this nationalistic sentiment. Samuel Gregg, a political economist at the American Institute for Economic Research, asserted that placing restrictions on U.S. financial services in the UK and EU would ultimately harm European economies. “It would be a monumental challenge for Europe to fill the vast gap created by such restrictions,” he warned, adding that the consequences of U.S. tariff increases would only exacerbate the situation.

0 Comment(s)